Our Story

Our profound expertise in the Credit Union and Community Bank sectors, combined with our unique model and 170 years of history, allows us to provide unparalleled, service-focused partnership options that other traditional third party service providers cannot deliver. We understand the specific challenges and opportunities inherent in the Credit Union and Community Bank industries and are well-positioned to effectively support the goals and objectives of each partner with customized strategies.

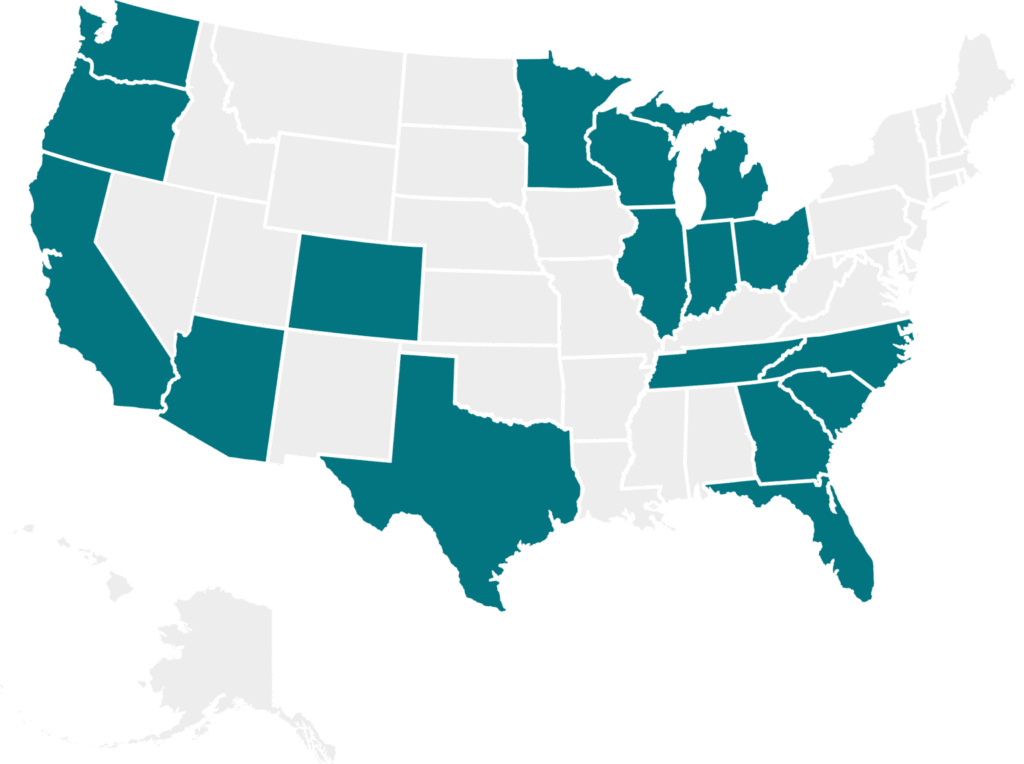

Based in the Chicagoland area and serving across the United States, we have relationships with dozens of investors, which allow us to deliver a comprehensive suite of personalized mortgage options and real estate services that meet each of our borrowers’ individual needs. Our partners count on our team of seasoned operational professionals known for their service excellence to help make the dream of homeownership a reality for their customers.

1855

1855  1871

1871  1897

1897  1930’s

1930’s  1962

1962  1970’s

1970’s  1988

1988  2003

2003  2011

2011  2011 & 2012

2011 & 2012  2012-19 & 2022-23

2012-19 & 2022-23  2017 – 2020

2017 – 2020