We’re all familiar with the term FICO score, which we can easily obtain through various means, including apps, credit card companies, banks, and when applying for credit. That three-digit number holds a lot of power — the ability to obtain financing and ultimately how much that financing will cost, i.e., the rate offered. But did you know that FICO is a company? The actual name, Fair Isaac Corporation, is a publicly traded company that provides a credit scoring model used in providing consumer financing. But they are not the only game in town. There are dozens of other companies that provide similar services, with the most well-known being VantageScore.

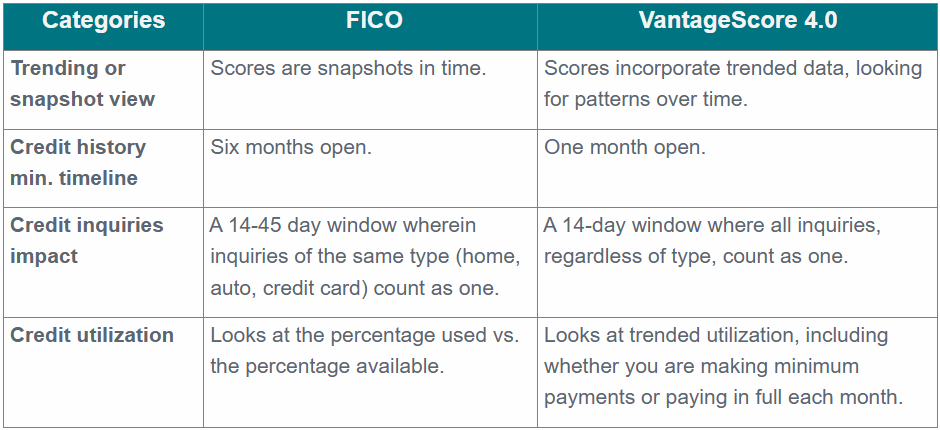

VantageScore differs from FICO in the way it looks at and utilizes consumer data, with the emphasis on using a shorter period to analyze consumer credit history, with the idea that it could potentially be more inclusive for individuals new to credit or who use it infrequently.

In the past week, the director of the FHFA, the agency that was established to oversee Fannie Mae and Freddie Mac, called for the immediate acceptance by Fannie and Freddie to allow the VantageScore model rather than the original timeline of the fourth quarter of 2025. Below, we’ll take a closer look at the differences between FICO and VantageScore 4.0 and then discuss the reality of the directive.

So what does this all mean — will more or fewer consumers be able to obtain a mortgage, and if so, when?

Therein lies the million-dollar question — and the answer is we don’t know, and we don’t know when. Legacy automated underwriting systems need to be updated, and guidelines rewritten. And what will all of these updates cost, and will there be any real savings passed on to the consumer? What we do know is that change is coming, and our plan at Key Mortgage is to ensure we continue to stay on top of these changes that ultimately will help clients finance homes in the most efficient and cost-effective way possible.